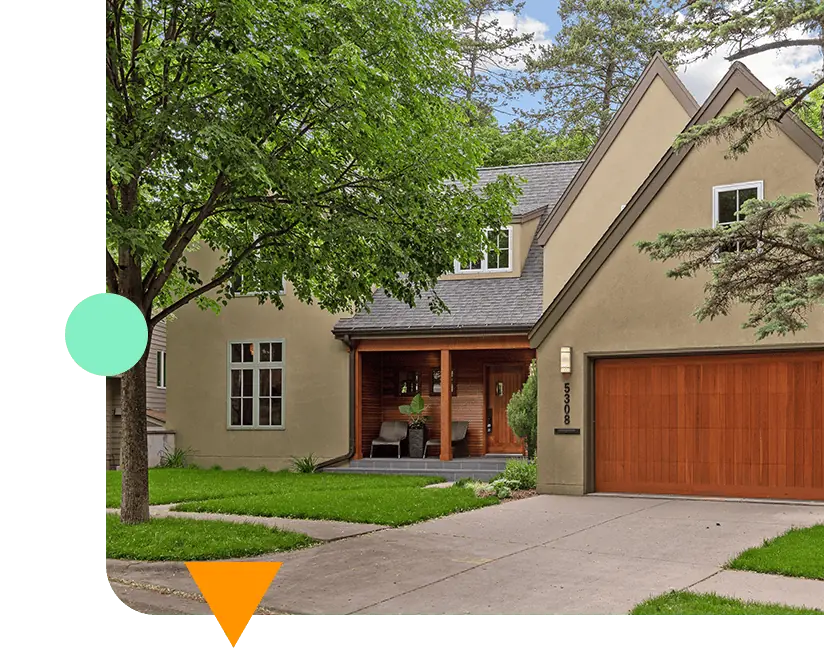

Fast and Reliable Bridge Loans

Our seasoned team ensures an uncomplicated and transparent journey from application to approval. We’re committed to simplifying the borrowing experience, guaranteeing you have the financial support to realize your ambitions.

Whether you’re a property investor on the lookout for short-term finance for a promising deal, an entrepreneur needing operational capital, or a homeowner aiming for renovation financing, we stand ready to support. Our bridge loans seamlessly connect your immediate financial needs with your overarching monetary aspirations.

Investor Capital prides itself on offering adaptable loan terms, appealing rates, and a wide spectrum of loan packages tailored to individual preferences. Acknowledging that every client has distinct necessities, our approach involves closely collaborating with you to craft a loan structure that mirrors your goals and financial prowess.

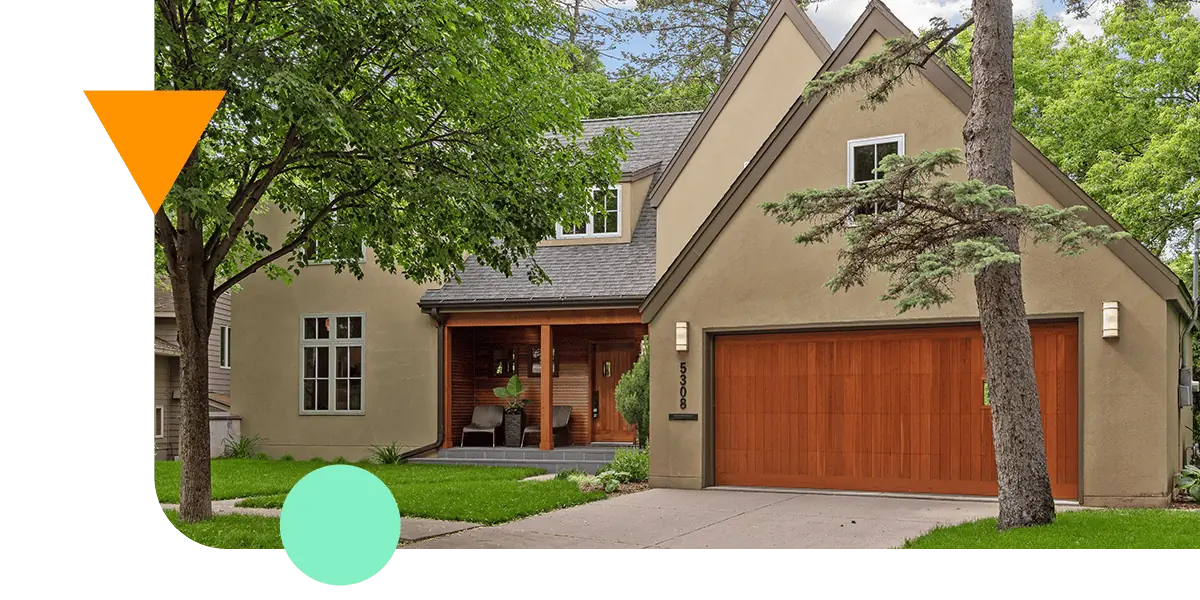

What is a Bridge Loan?

Dubbed as swing loans or gap financing, bridge loans act as interim financing tools designed to bridge financial divides in various scenarios. They’re predominantly favored in property dealings, offering on-the-spot financing for purchases when funds are momentarily tied up.

For illustration, an individual might employ a bridge loan to snap up a new estate while their current one awaits a buyer. This loan provides the immediate finances to seal the deal, which the individual then settles after selling their existing asset.

Get Funded Today

How Does a Bridge Loan Function?

Typically carrying heftier interest rates than their standard counterparts, bridge loans are short-lived, often maturing within 6-12 months. They’re anchored by collateral, like the property in transaction or even the borrower’s existing asset. Lenders might sometimes seek a significant upfront amount to balance out potential risks.

In essence, bridge loans extend a lifeline for those in pursuit of immediate capital, be they real estate aficionados, business magnates, or homeowners eyeing short-term finance. They proficiently bridge current financial necessities with more extensive future aims.

Experience rapid results with turnaround times clocking in at just 24 hours. Get in touch now to discover what’s possible!

Challenges with W-2’s or tax returns in the past? We’ve got you covered! Our hard money loans can be founded on your assets and self-declared income.

A limited credit history or a less-than-stellar score isn’t a roadblock for us. We prioritize your assets and the Loan-to-Value (LTV) ratio. Let’s discuss the perfect solution tailored for you!

With Investor Capital, you have the potential to access up to 85% LTV or LTC. In some unique scenarios, this could extend up to 90%! Dive into the opportunities awaiting you; get in touch now!