Customized Financial Solutions

Our family-centric approach empowers us to customize financial solutions that not only meet but surpass your expectations! With some products enabling funding in as quick as 24 hours, our primary aim is to support your financing needs promptly.

Mobile and Manufactured Homes Predating 1976

It’s a known challenge: mobile homes built before 1976 often don’t align with HUD code standards, regardless of subsequent modifications. Consequently, many government bodies, including FHA, refrain from insuring mortgages for manufactured homes crafted before June 15th, 1976. This has traditionally made financing for these properties a daunting task.

But Investor Capital is different. We proudly extend loans for these older mobile and manufactured homes, paving the way for you to capitalize on the investment opportunities they offer.

Get Funded Today

Loans for Un-Affixed Mobile Homes

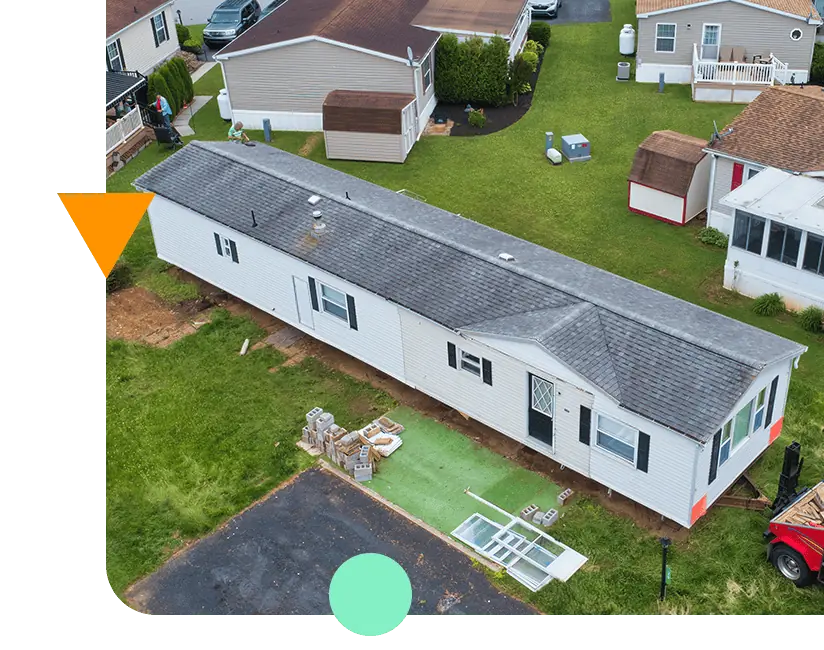

Many modern mobile home owners, particularly those post-1976, face unique financing hurdles. If your mobile home isn’t fixed to land or if it’s been relocated, most conventional lenders might shy away.

Whether your mobile home has traveled or remained stationary, we’re devoted to assisting you with its financing.

Single Wide Loans

But whether you own a single wide or a double, Investor Capital is keen on being your dependable finance partner.

Experience rapid results with turnaround times clocking in at just 24 hours. Get in touch now to discover what’s possible!

Challenges with W-2’s or tax returns in the past? We’ve got you covered! Our hard money loans can be founded on your assets and self-declared income.

A limited credit history or a less-than-stellar score isn’t a roadblock for us. We prioritize your assets and the Loan-to-Value (LTV) ratio. Let’s discuss the perfect solution tailored for you!

With Investor Capital, you have the potential to access up to 85% LTV or LTC. In some unique scenarios, this could extend up to 90%! Dive into the opportunities awaiting you; get in touch now!